Problemet er at mens det tog Europa omkring 5 år at overføre en smule over € 200 milliarder af udsat Græsk privat gæld til statslige instanser ( i form af ECB, EFSF, ESM og et utal andre other ad hoc forkortelser) på bekostning utallige topmøder og uendelige forhandlinger, som måske eller måske ikke følger med den fælles valuta som det første offer, som måske vil vise sig at være vendbar så snart som i næste uge, så vil ingen i Europa have nogen tvivl om at den samme øvelse kan gentages med Italien, eller Spanien, eller selv Portugal. De er bare for store (og deres misligholdte lån løber op i hundreder af milliarder).

Og dog, idag, i et overraskende fremstilling af splittelsen indenfor Troikaen, så var det den Internationale Valutafond (IMF) som udtrykkeligt erklærede at Grækenland ikke længere er holdbar medmindre der er både givet yderligere støtte til landet, hvilket kan kun ske hvis der er et andet massivt hårklip i gælden.

Kommentar: Vi undskylder at resten af artiklen ikke er oversat, men vores resourcer er begrænsede. Hvis du har lyst til at hjælpe med at oversætte så skriv blot til sott_da@sott.net

This is what the IMF said:

Even with concessional financing through 2018, debt would remain very high for decades and highly vulnerable to shocks. Assuming official (concessional) financing through end - 2018, the debt-to-GDP ratio is projected at about 150 percent in 2020, and close to 140 percent in 2022 (see Figure 4ii). Using the thresholds agreed in November 2012, a haircut that yields a reduction in debt of over 30 percent of GDP would be required to meet the November 2012 debt targets. With debt remaining very high, any further deterioration in growth rates or in the medium term primary surplus relative to the revised baseline scenario discussed here would result in significant increases in debt and gross financing needs (see robustness tests in the next section below). This points to the high vulnerability of the debt dynamics.And the kicker:

"these new financing needs render the debt dynamics unsustainable."Bingo, because that is, in a nutshell, precisely what Tsipras and Varoufakis have been claiming since day one. As expected, a Greek government spokesman promptly said that the IMF report is in line with the Greek government's view on debt.

What makes the IMF report even more odd, is not so much its content and position which have been largely known for quite some time now, but its timing: just three days before the Sunday referendum, Tsipras now has prima facie evidence to wave in front of the Greek people and say "see, we were right all along."

It is exactly the case that only a "No" vote at this point would allow Greece to continue a negotiation which has already seen one of the three Troika members side with the Greek position. Should Greece vote "Yes", it will make any future negotiation with the Troika impossible, and while the country will get a few months respite the resultant bank run after the bank reopen with the ECB's blessing will mean that all Greece will do is buy itself a few months time. Only this time all the debt will still be due.

And, should they vote "Yes", this time the Greeks will only have themselves to blame for all the future pain, pain which will continue well after the mid-point of this century.

But ignoring Greece for a minute, what the IMF's "debt sustainability analysis" has just done is open the door for every single other comparably insolvent peripheral European nation to knock on Christine Lagarde's door and politely ask: "Mme Lagarde, if Greece is unsustainable, then why aren't we?"

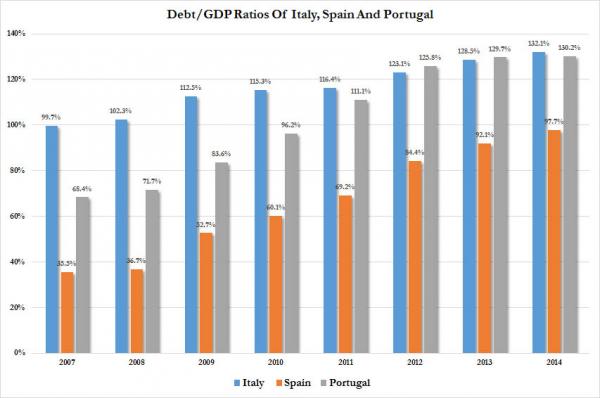

Because as the chart below shows, the debt situations of all the other peripheral European nations is just as "unsustainable."

In this way, while the outcome of the Greek situation is currently unknown, it has also become moot, because at this very moment, politicians from Spain's Podemos to Italy's Five Star movement are drafting memos demanding that the IMF evaluate their own debt sustainability. Or rather unsustainability.

Perhaps more importantly, these same politicians will now dangle the prospect of an IMF admission that they, too, deserve a haircut as the catalyst to be elected into power. After all who can refuse that their life would be made so much better if only the country was permitted to selectively "default" on €50, €100, €200 billion or more in debt? Just elect this politician, or that, and watch your living standard soar...

And since the IMF has no choice but to agree that just like Greece all these nations are accordingly drowning in debt, Syriza's sacrifice (assuming Tsipras fails to outnegotiate Merkel) will not have been in vain. In fact, it may very well end up that today the IMF opened up the Pandora's box, one which, more than a Grexit, will destroy Merkel's "united Europe" legacy.

Kommentar: My oh my, what the psychopaths have wrought.